HIGHLIGHTS

- Crude equivalent to around 20% of seaborne trade volumes

- Maritime trade may double by 2050

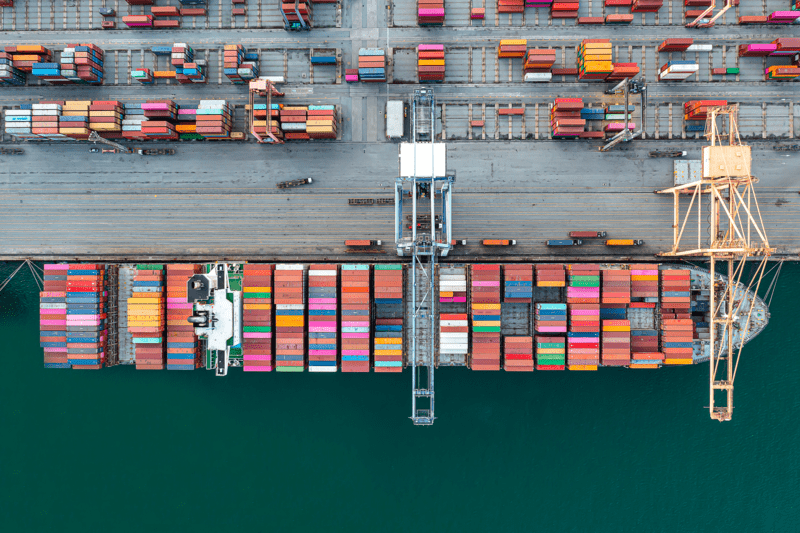

Climate change threatens around $7.6 billion a year of port infrastructure, risking energy flows, according to a report by JP Morgan.

Ports are exposed to significant risks from natural hazards such as hurricanes, typhoons, floods and earthquakes, and the annual expected median value-at-risk for port infrastructure is $7.6 billion, JP Morgan said in a report about climate risks and the future of global trade.

With sea levels projected to rise by up to 40 cm between 2020 and 2050, ports such as Houston, Antwerp and Shanghai face threats that could compromise their operational capabilities, the report said.

"Necessary infrastructure upgrades and expansions will take capital," JP Morgan said. "Otherwise, ports risk damage and resulting global trade disruptions, potentially threatening economic security."

The Port of Houston is a hub for energy exports and imports and is particularly vulnerable. A single severe weather event could lead to cascading effects, disrupting trade and causing billions in damages, the report said. The port's proximity to the Gulf of Mexico makes it susceptible to hurricanes, as seen during Hurricane Ike in 2008, which caused $2.4 billion in damage to Texan ports, it said.

The cost of damage to infrastructure does not include the risk to cargoes. At Houston, 773,000 b/d of crude and dirty products and 793,000 b/d of clean petroleum products were loaded in 2024, according to data from S&P Global Commodities at Sea.

Platts, part of S&P Global Commodity Insights, assessed Platts AGS, reflecting WTI Midland grade transported to the Gulf Coast from the Permian Basin, at an average of $77.84/b in 2024.

Global trade in 2024 was valued at $33 trillion, with over 70% by value in maritime transport, JP Morgan said. The bulkiest items are transported by water; when measured by volume of goods, 80% of global trade is transported by sea. By volume, around 40% of all seaport transport is for fossil fuels and approximately half of that is for crude oil, according to the report.

This implies crude accounted for around 20% of seaborne trade volumes in 2024.

Maritime trade is expected to grow in the coming decades, with estimates from the Organization for Economic Cooperation and Development suggesting it could more than double by 2050, JP Morgan said.

The implications of disruption extend beyond the ports themselves. The interconnected nature of global supply chains means that disruptions in one port can ripple through the entire system, affecting energy availability and economic security worldwide. Without strategic planning and investment, some ports risk becoming obsolete, jeopardizing the flow of goods and energy, JP Morgan said.

While mitigation efforts to reduce greenhouse gas emissions are underway, adaptation planning is lagging. Ports could consider creating flood plains, such as restoring wetlands or coastal ecosystems, JP Morgan said.