The EU has embarked on the most significant revamp of its oil sanctions against Russia in more than two years, cutting the oil price cap and initiating an import ban on petroleum products made from Russian crude, among other measures.

In its 18th sanctions package against Russia, Brussels introduced a floating pricing mechanism for the Russian crude price cap with an initial threshold of $47.6/b, a unilateral move partially backed by the UK while other Western allies' stances remained uncertain.

The EU had previously teamed up with G7 countries to ban maritime service firms from transporting Russian crude unless the barrels were sold for no more than $60/b from December 2022, and analysts suggested the market impact of the policy change could be limited unless Washington also tightened sanctions on Russia.

Brussels, which has prohibited the imports of Russian refined products since February 2023, also announced it would also ban oil products refined from Russian crude in third countries in six months' time, but implementation details are not clear.

"This is bullish for European and Atlantic Basin diesel cracks as well as Middle East crudes and other grades available to Indian refiners in lieu of Russian crude, if the sanctions prove enforceable," S&P Global Commodity Insights analysts said in a note, suggesting the top Russian crude-importing nation could need to find replacement barrels.

"It remains unclear how the EU will be able to distinguish refined product imports from countries where Russian crude is just a part of the mix," they added.

The EU separately blacklisted over 100 ships for transporting Russian oil in breach of the price cap in its latest package, while clamping down the illicit shipping network, and it also targeted the Rosneft-backed Nayara Energy in India in its first action of this kind.

Prices

- The EU's new price cap for Russian crude of $47.6/b will come into force on Sept. 3, and the bloc will set the next threshold at 15% below the average market price of Urals, Russia's flagship crude, in the 22 weeks from July 15.

- The EU cap is due to be amended on Jan. 5, 2026 and every six months thereafter, unless the new cap varies by 5% or less from the earlier one.

- The UK has made the same reduction in the price cap but has yet to commit to the floating mechanism. Both the UK and EU have not made changes to the price caps for Russian oil products.

- Platts assessments show Urals has been mostly traded below $60/b on a free-on-board Primorsk basis since late February and was last assessed at $58.48/b on July 18 when the EU sanctions were announced.

- The discount of Urals to Dated Brent on a delivered-at-place West Coast India basis has been at $1.80/b since July 10, the narrowest level since the assessment was launched in January 2023.

- The ICE September Brent futures contract was down 35 cents/b from the previous close at $67.28/b at 1109 GMT July 21, while NYMEX August light sweet crude decreased by 20 cents/b to $69.08/b.

- The front-month August low sulfur gasoil futures contract was up $14.75 on the day at $726.50/mt on July 18, while the prompt August/September spread, a key gauge of market tightness, widened $2.50 to $19.75/mt.

- Platts assessed CIF Northwest Europe jet fuel cargo at $768.50/mt on July 18, up $12.50/mt day over day but down $2.25/mt as a premium to the front-month ICE low sulfur gasoil at $42/mt.

- Ultra low sulfur diesel barge's crack against Brent jumped 5.97% to $28.39/b on July 18, on an FOB Amsterdam-Rotterdam-Antwerp basis.

Trade flows

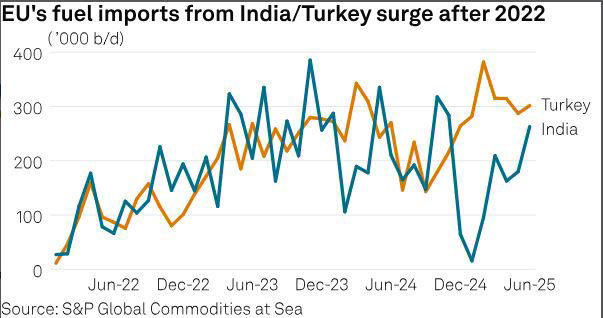

- New EU sanctions have put the spotlight on India and Turkey, which have hiked imports of Russian crude and exports for refined products to Europe since 2022.

- According to estimates from Commodity Insights analysts, the ban will potentially impact 250,000 b/d of diesel shipments to the EU from Turkey and India, which rely heavily on Russian crude oil.

- Russia in June exported 1.66 million b/d of seaborne crude to India, its top market, and 383,000 b/d to Turkey, its No. 3 market, according to S&P Global Commodities at Sea.

- Europe imported 124,000 b/d of gasoil/diesel from India and 94,000 b/d from Turkey in June, representing 7% and 5% of its total, respectively, CAS data shows. The US and Saudi Arabia were Europe's largest suppliers in June, delivering 380,000 b/d and 190,000 b/d, respectively, CAS data showed.

- An additional draw on US and Middle Eastern supplies could have repercussions for Africa and Latin America if supplies are redirected.

- Nayara Energy's Vadinar refinery, now on the EU sanctions list, has received 403,000 b/d of crude so far this year, out of which 72% has been Russian-origin crude grades based on CAS estimates.

- The 400,000-b/d facility has exported 125,000 b/d of clean and dirty products, of which just 5,038 b/d routed to EU member states -- all of them jet/kerosene.

Logistics

- The EU sanctioned 105 ships in its latest enforcement, bringing the total number of blacklisted vessels to 444.

- CAS data shows the recently sanctioned ships have lifted 734,000 b/d of crude and oil products from Russia so far this year.

- Brussels also sanctioned the captain of a shadow fleet ship for the first time, as well as Intershipping Services that operated the flag registries for Gabon and Comoros.

- The UK separately sanctioned 135 tankers involved in sanctioned Russian oil trades, which, according to the Foreign Office, had been transporting $24 billion worth of cargo since ealy-2024.

- But analysts expect shadow fleet operators, which control sanctioned tankers and non-sanctioned ships likely operating outside of the price cap, to have more opportunities hauling Russian oil with the new EU cap driving Greek companies away from Russia.

- The number of tankers confirmed by Western authorities to have violated sanctions or at high risk of breaching them reached 940 as of May, or 17% of the global in-service tanker capacity, according to a joint study by Commodity Insights and S&P Global Market Intelligence.

- G7-linked tankers lifted over 39% of Russia's 3.36 million b/d crude exports in June, the highest since the end of 2023, according to CAS and Maritime Intelligence Risk Suite data.

- Tanker operators in Greece, Europe's top shipowning nation, were responsible for lifting 24.5 million barrels of Russian crude in June, the highest since August 2023.

- The EU also removed three LNG tankers from its sanctions list, suggesting it believes that the ships would no longer serve Russia's Yamal LNG and Arctic LNG 2 projects.

- But Brussels listed a Russian LNG entity and issued full transaction plans on the Nord Stream and Nord Stream 2 gas pipelines that will bar their future use.